As you may be aware the government postponed the reforms to the off-payroll working rules (IR35) from April 2020 to 6 April 2021. This is a deferral of the introduction of the reforms, not a cancellation. The government remains committed to introducing this policy to ensure that people working like employees, but through their own limited company, pay broadly the same tax as individuals who are employed directly. The policy will be introduced on 6 April 2021 representing a 12-month delay.

As you may be aware the government postponed the reforms to the off-payroll working rules (IR35) from April 2020 to 6 April 2021. This is a deferral of the introduction of the reforms, not a cancellation. The government remains committed to introducing this policy to ensure that people working like employees, but through their own limited company, pay broadly the same tax as individuals who are employed directly. The policy will be introduced on 6 April 2021 representing a 12-month delay.

What does this mean?

The changes will ensure that people working like employees, but through an intermediary pay broadly the same Income Tax and National Insurance contributions as regular employees. This will include those who work through their own limited company.

From 6 April 2021, medium-sized and large organisations outside the public sector will be responsible for deciding the employment status of contractors for tax purposes. Currently, contractors themselves are responsible for making this decision if they are providing services for organisations outside the public sector. HMRC has announced that the change will only apply to payments made for services on or after 6 April 2021. This means organisations will only need to make a determination about whether the rules apply for contracts they plan to continue beyond 6 April 2021.

The reforms were announced in Budget 2018, and will bring the private sector into line with the public sector where these rules have applied since 2017. The rules aren’t changing for those PSC’s who are providing services to a small business. That is a business meeting two or more of the following conditions:

- an annual turnover of not more than £10.2 million

- a balance sheet total of not more than £5.1 million

- not more than 50 employees

The reforms don’t introduce a new tax – they are designed to improve compliance with existing rules and make sure the right tax is paid from April 2021 onwards. Because of that, HMRC never uses any information resulting from the off-payroll changes to open a new enquiry into a PSC’s compliance before the changes were made. An investigation will only be opened if there is evidence of criminal behaviour.

Outside of the public sector, HMRC estimates that only one in ten people who should be paying tax under the current off-payroll working rules are paying the right amount. Currently, an individual earning £50,000 who works through their own company, but not following the rules, contributes around £6,000 less (through tax, National Insurance and employer’s NICs) than an employee sitting next to them doing a very similar job.

The rules only apply to individuals who are working like employees under the current employment status tests, and do not apply to the self-employed. The rules also do not prevent people from working through their own limited companies in future.

Clients cannot apply a blanket rule across all contractors. They must take reasonable care when making decisions about whether the off-payroll working rules apply. Applying a decision to a group of off-payroll workers with the same role, working practices and contractual terms may be permissible in some circumstances, but it is not right to rule all engagements to be within or outside of the rules irrespective of the contractual terms and actual working arrangements.

HMRC wants to encourage contractors to not be tempted by tax avoidance schemes, including those that claim to ensure that contracts are not affected by IR35 or that otherwise offer to increase take home pay. If something looks too good to be true, it probably is.

HMRC is providing a comprehensive programme of education and support to help organisations and contractors get ready for the reform. This includes one-to-one engagement and targeted communications for some of the UK’s biggest employers, as well as webinars, workshops, roundtable events and online tools and guidance.

HMRC has also published updated guidance in the Employment Status Manual to further help businesses and individuals to prepare.

Check Employment Status for Tax

Check Employment Status for Tax

The Check Employment Status for Tax tool is free to use, and helps individuals and organisations decide if a worker should be treated as employed for tax purposes. It takes users through straightforward step-by-step questions. An enhanced version of the tool was launched last November. The tool was rigorously tested against case law and settled cases by officials and external experts CEST is accurate and HMRC will stand by the result produced by the tool provided the information input is accurate and the tool is used is in line with the guidance.

Know the Facts

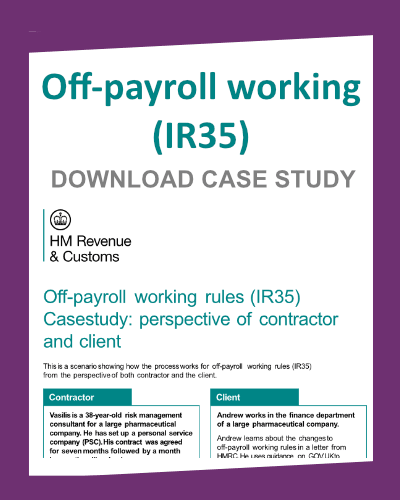

I would like to look at more case study example scenarios

Webinars

Webinars

Off-payroll working rules from April 2021: Contractors

HMRC is running a range of off-payroll webinars through to April 2021.

Register for the next live webinar about off-payroll rules from April 2021 for contractors. This webinar gives an overview of the changes to the off-payroll working rules which come into effect on 6 April 2021. It is specifically designed to help contractors understand what these changes will mean for them. Dates will be added when they become available.